It’s estimated that between now and 2030, around 10,000 people per day will have their 65th birthday. If you’re one of the people celebrating that major milestone in the near future it’s important that you take some time to understand your options under the Medicare system so that you can sign up for the right coverage.

Navigating the Medicare System

If you’re over 65, or will turn 65 in the next three months, and you aren’t currently in receipt of Social Security benefits, you will need to sign up for Medicare. You won’t get enrolled automatically.

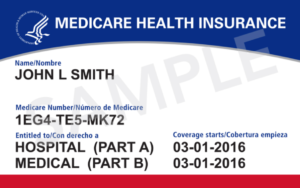

Medicare is made up of four parts:

- Part A covers stays in hospital

- Part B covers physician visits

- Part C allows Medicare users to receive care from a wider variety of providers

- Part D covers prescription medications

In addition to those parts, there are Medigap policies that offer people enrolled in Parts A and B additional coverage.

What Medicare Coverage Do You Need

Medicare is usually offered either as “Original Medicare” with Parts A and B, or “Medicare Advantage”, a bundled plan that includes Part A and Part B, with some plans also including Part D and some additional benefits such as dental plans, vision, and hearing care.

It’s a good idea to plan ahead when it comes to your care. If you don’t opt for Part D when you are first eligible, you could face late enrollment penalties. The same is true for Medigap. Obtaining cover at a later date is likely to cost you a lot of money.

Under Original Medicare, you have the freedom to choose any Medicare provider, anywhere in the United States, but there will be co-pays, and you will also need to enroll in Part D separately for drug coverage. With Advantage offerings, your out-of-pocket costs will most likely be lower, but you will typically be restricted to doctors that are in the plan’s network.

If you’re looking for advice about Medicare supplement plans, or aren’t sure what type of health insurance would be best for your needs, Barstow Just Us Insurance Services is here to help. We have a good understanding of the Medicare market and can explain the cover options available in your area and which plans are most likely to suit your budget, provider preferences, and needs. We can also offer advice about Medicare Advantage plans and also explain the out-of-pocket costs that you are likely to face on different plans.

If you are due to qualify for Medicare soon, or you already do qualify and are not yet enrolled, it’s imperative that you act quickly. Get in touch with the team at Barstow Just Us Insurance Services today so that we can save you money and give you peace of mind that your health insurance is sorted.